How To Change Workers Comp Rate In Quickbooks

Thank you for calculation more than details about your business organization, SaraBee.

Every bit mentioned past my colleague, recreate the code, and enter the correct ane. This is to ensure y'all can enter the correct date. Then, perform a manual adjustment to keep your payroll records in social club.

We'll take to do this per employee to get an authentic corporeality. Also, the new charge per unit volition automatically utilise to future payroll.

To get-go, pull upwardly the Payroll Summary Written report and select a per quarter date range to get the accurate amount for the employees afflicted. Here'southward how to open up information technology.

- Become to the Reports menu at the top and choose Employees & Payroll to select Payroll Summary.

- From the Dates driblet-down, option the specific quarter

- Hit the Refresh button.

- Next, click the amount for the payroll detail beside the worker's name to run into the complete details.

- On the Transactions by Payroll item page, navigate to the Wage Base column and have notation of the full amount.

- And then, multiply the Wage Base corporeality to the rate.

- Continue performing this procedure to all the employees you're working on.

Once you lot take all the information, you tin start creating liability adjustment. Here's how:

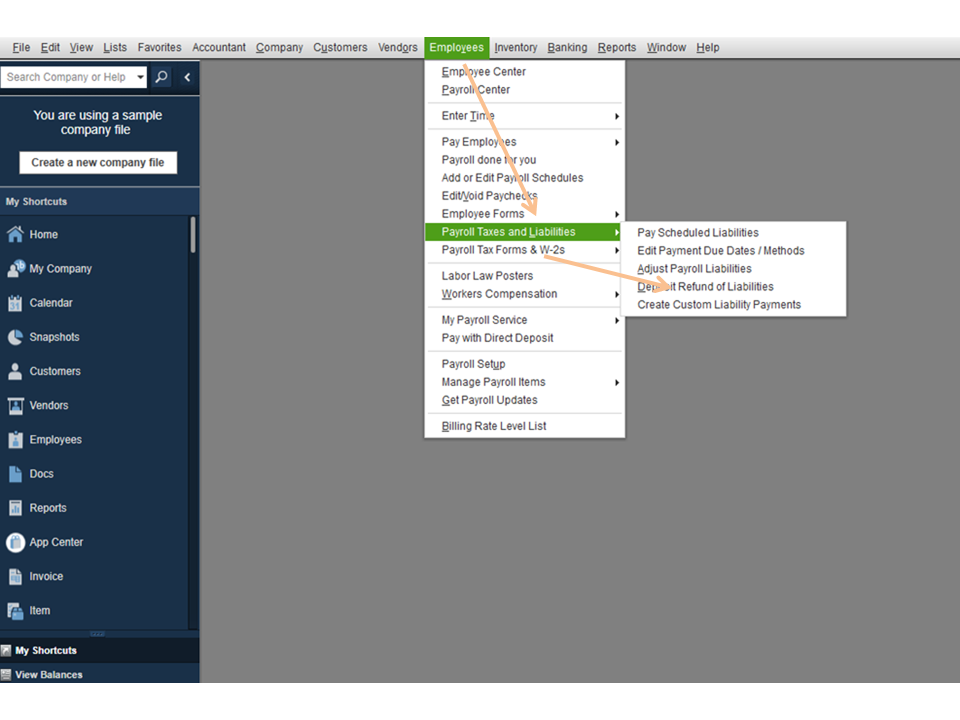

- Tap the Employees menu and option Payroll Taxes and Liabilities to select Accommodate Payroll Liabilities.

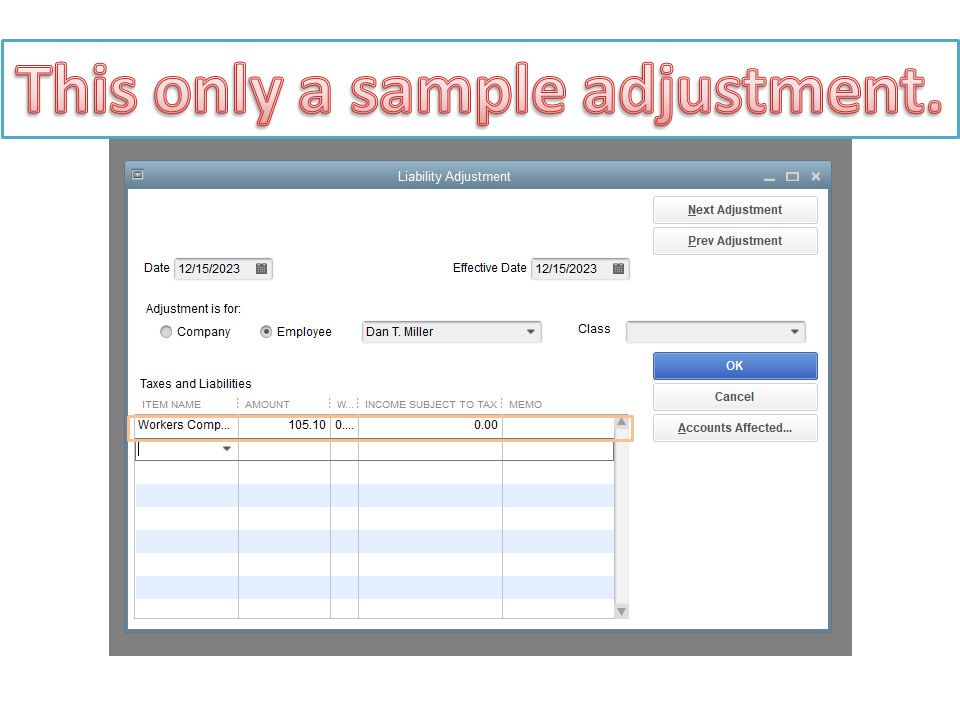

- In the Liability Aligning window, use the same appointment as the last paycheck of the affected quarter. Otherwise, enter today'due south date if you're working on the current quarter.

- The Constructive Appointment is used to calculate amounts on your 940 and 941 forms as well as the Payroll Liability Balances Report.

- In the Adjustment is for section, tick the box for Employee and choose the worker's name from the drop-down.

- In the Particular Name drop-downward, pick Workers Bounty and blazon the adjusted effigy in the Corporeality column.

- Click the Accounts Affected push to choose any of the following:

•Do not bear upon accounts to leave balances unchanged for the liability and expense accounts. The adjustment will just modify the yr-to-engagement amounts on your payroll reports.

•Bear on liability and expense accounts to enter an adjusting transaction in the liability and expense accounts. - Hit the OK button and press Next Adjustment to continue.

For more than insights into this process, check out this commodity: Conform payroll liabilities in QuickBooks Desktop.

Additionally, this guide provides tips to assistance resolve payroll revenue enhancement returns problems: How to fix common Payroll errors in QuickBooks.

Click the Respond button if you need farther assistance performing whatsoever of these steps. I'll be glad to help and brand sure you lot're taken intendance of. Relish the rest of the twenty-four hour period.

Source: https://quickbooks.intuit.com/learn-support/en-us/employees-and-payroll/edit-workers-compensation-code/00/207910

Posted by: smithfoure1955.blogspot.com

0 Response to "How To Change Workers Comp Rate In Quickbooks"

Post a Comment